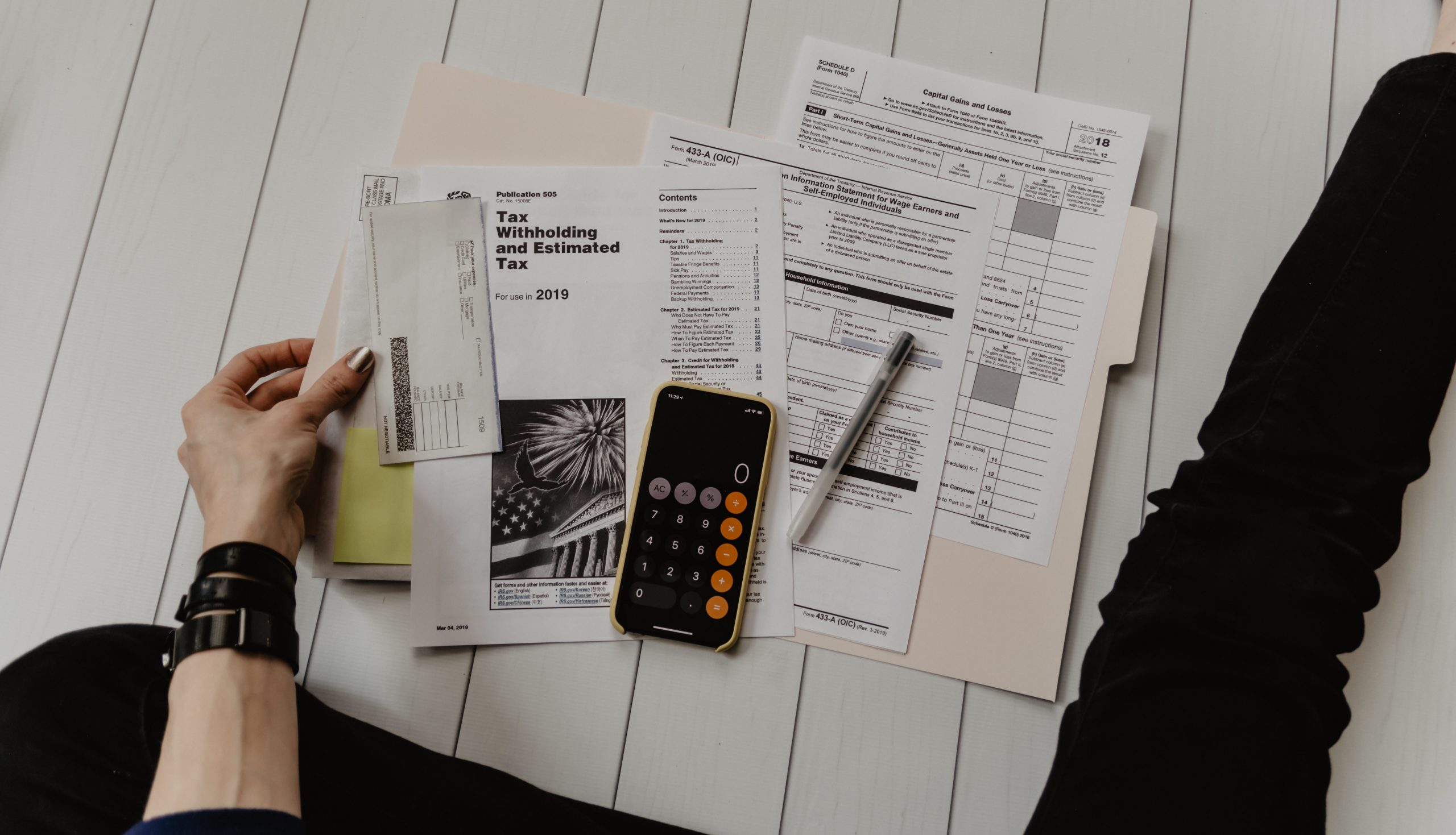

Small business owners often have limited time and resources, and keeping track of their finances can be challenging. However, accurate bookkeeping is essential for the success of any small business. It helps to track income and expenses, manage cash flow, comply with tax regulations, and make informed financial decisions. In this blog post, we’ll explore the options available to small business owners for bookkeeping.

DIY Bookkeeping

One option for small business owners is to handle their bookkeeping themselves. This approach is often the most cost-effective, but it can also be time-consuming and challenging, especially for those who aren’t familiar with bookkeeping basics. Small business owners who choose this option will need to keep track of their financial transactions, reconcile accounts, and create financial statements. They will also need to stay up-to-date with tax regulations and prepare their tax returns.

Bookkeeping Software

Another option for small business owners is to use bookkeeping software. Bookkeeping software, such as QuickBooks, Xero, or Wave, simplifies the bookkeeping process by automating tasks and providing an easy-to-use interface. Small business owners can enter their financial transactions into the software and generate financial reports quickly. Additionally, many bookkeeping software programs have integrations with banks and other financial institutions, making the process of reconciling accounts more straightforward.

Hire a Bookkeeper

Small business owners who want to outsource their bookkeeping can hire a professional bookkeeper. A bookkeeper can handle all bookkeeping tasks, including keeping track of financial transactions, reconciling accounts, and generating financial reports. They can also help with tax compliance and preparing tax returns. Hiring a bookkeeper can free up small business owners’ time, allowing them to focus on growing their business. However, it can also be costly, especially for small businesses with limited resources.

Hire an Accountant

Small business owners can also hire an accountant to handle their bookkeeping. Accountants can offer more specialized financial advice, and they can also provide additional services, such as budgeting, forecasting, and financial analysis. Accountants can help small business owners make strategic financial decisions and grow their businesses. However, hiring an accountant can be expensive, and many small businesses may not need the additional services they offer.

Hybrid Option

A final option for small business owners is a hybrid approach, combining some of the other options. For example, small business owners can use bookkeeping software to manage their day-to-day financial transactions and reconcile their accounts, while hiring a bookkeeper or accountant to review and analyze their financial reports periodically. This approach can provide the benefits of both DIY bookkeeping and professional bookkeeping, but it can also be more costly than either option alone.

In conclusion, small business owners have several options for bookkeeping. DIY bookkeeping, bookkeeping software, hiring a bookkeeper or accountant, and a hybrid approach are all viable options. The best option for each small business will depend on their specific needs, budget, and resources. Regardless of the option chosen, accurate bookkeeping is essential for the success of any small business. It helps to track income and expenses, manage cash flow, comply with tax regulations, and make informed financial decisions. By choosing the right bookkeeping option, small business owners can set themselves up for long-term success.